Biden / ECB balance-sheet down / SEK / JPM on AI deflation / CS / Fed officials : no pivot yet

- Feb 9, 2023

- 5 min read

ECB deleveraging continues. ECB balance sheet has shrunk by another €18.6bn in the past week to €7,875.4bn as QE redemptions > QE reinvestments. Total assets now equate to 60.3% of Eurozone GDP vs Fed's 32.3%, SNB's 114.7%, BoJ's 132.4%, ECB BS going down faster then FED's balance-sheet !!

Biden played a masterclass at the State of the Union - read below

CS forecasts substantial net loss for 2023

Fed officials keep pushing back against any pivot expectations. Waller said rates may have to stay higher for longer, Williams called the Dec dot plot a good guide, adding that rates are "barely into restrictive" territory, Cook yesterday, said "we are not done yet.", Kashkari expects the peak to rise above 5% this year. Traders are starting to put big money on the possibility that the Fed tightening cycle has more room to run. Several hefty wagers that the peak rate will reach 6% — nearly a percentage point higher than the current consensus — have popped up this week in different ways, this is the key for markets, broadly speaking Terminal has been priced at 5.25% area, if we have to go to 6% it's a diff ball game

Xi rejects "Westernization" and promotes China’s self reliance in new policy speech

Remember the 'egg craze''..Wholesale egg prices have fallen by more than 50% since December, according to Urner Barry data

Kashkari... “I pay attention to grocery prices. There is this large tray of lasagna that I used to buy that used to cost around $16. Now it’s around $21. That’s my own little measuring stick of how inflation is going,” he said.... really..

Fed's Williams: Financial conditions seem broadly consistent with the Fed's policy outlook, if financial conditions loosen too much, we would have to go higher on rates

"one quote sums up the attitude of the Chinese consumer…. "No one even talks about covid anymore"." - GS Asia Economics analyst

M2 and other money supply data forcing many to call for ''recession ''- these old data are not worth what they used to be in predicting anything serious..(not yet anyway with unemployment at 3.4%..)

Zelenskiy pushes for swift EU membership in first trip to Brussels since invasion. And he has taken his request for fighter jets to France and Germany following his calls in the UK for more support to help his country’s struggle against Russia’s invasion

JPMorgan snippet on AI:We are in the early stages of understanding the impacts of AI, let alone fully grasping the implications of the technology. From a business standpoint, AI could also prove VERY deflationary, not just for tech but for society (remains to be seen)

Coinbase's CEO Cites 'Rumors' the SEC May Ban Crypto Staking for Retail Customers

Greece bans parties with convicted leaders from running in elections

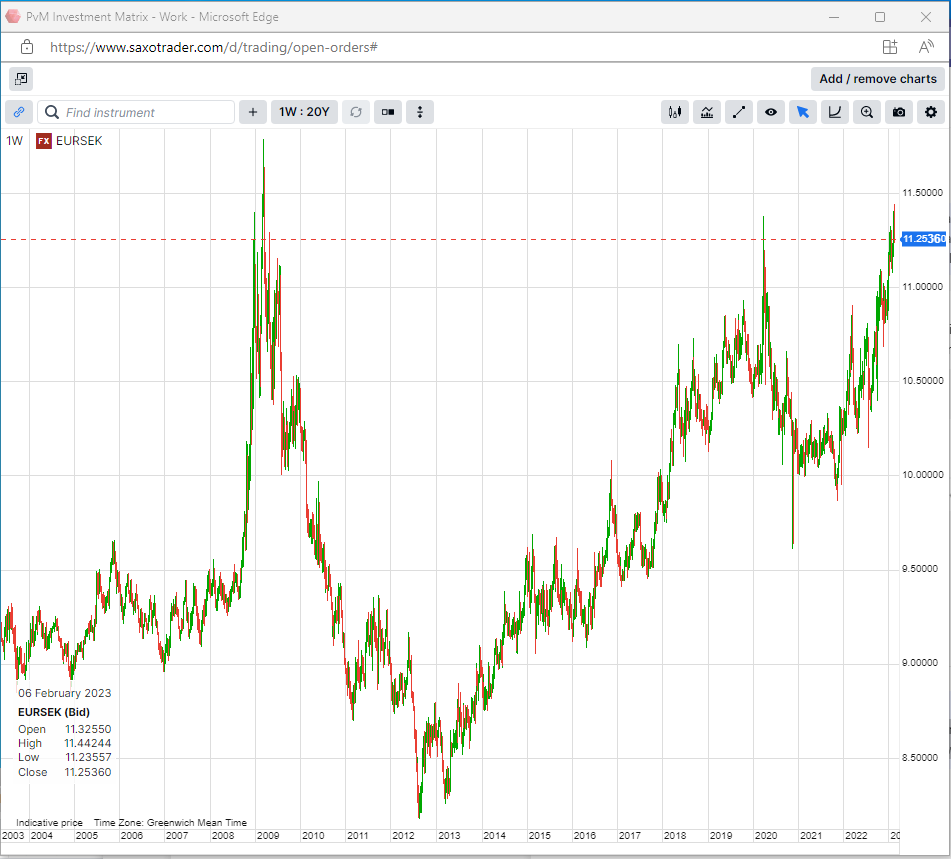

Riksbank hikes rates 50Bps to 3.00%; as expected, classic behind the curve situation etc etc, now forced to overtighten >>> SEK has been battered last few months, EURSEK near multi all time highs (chart below)

Markets :

SPX500 4150 clean weekly break required for 4300 during Q2 >> Latest AAII weekly survey showed investors are net bullish again -- not only for the first time in nearly a year, but also the MOST bullish since Nov. 2021. DAX only 4-5% off all time highs! FTSE100 new all time highs

BONDS steady, awaiting next week's U.S CPI, EZ inflation hedging lower as is expected by most market participants, 10y Bund getting back to 2.5% where it belongs, actually nearer to 3% probably more like it, but let's how goes from here

Crude a little firmer/steady

USDollar not exactly rallying beyond the short-covering post NFP so far...

Well worth a read, if you haven't already - An Executive Summary

In the introduction to this outlook for early 2023, Saxo CIO Steen Jakobsen argues that our economic models and our assumptions for how market cycles are supposed to work are simply broken. And so should they be, as why should we even want to return to the ‘model’ of central banks engaging in moral hazard and bailing out incumbent wealth, rentiers and risk takers, the rinse-and-repeat we have seen in every cycle since Fed Chair Greenspan bailed out LTCM in 1998? This new post-pandemic and post-Ukraine invasion era we find ourselves in has brought an entirely new set of imperatives beyond bailouts and reinflating asset prices. Instead, we need to brace for the impact of higher inflation for longer as we scramble for supply chain reshoring and redundancy, and as we transform our energy systems to reduce reliance on fossil fuels and reduce our impact on the climate. And it won’t be all pain for all assets. Quite the contrary; it will bring a refreshing return of productive investment and a brighter future for everyone Quarterly Outlook Q1 2023 - The models are broken | Saxo Group (home.saxo)

Love him or hate him..got to admit it was a clever play!

What else..Credit Suisse clients pull a record $120 billion in the fourth quarter, as a fifth-straight quarterly loss caps the Swiss lender's worst year since the financial crisis >>> HOWEVER, good news is leveraged ratios and so on in much better shape...so a clear deleveraging has happened, ready for the new old CS split CSFB direction etc etc, whether this is all good for shareholders is probably another discussion

Alphabet Stock Plunge Erases $100 Billion After New AI Chatbot Gives Wrong Answer In Ad (forbes.com)

EURSEK - Riksbank has been behind the curve all the way..

Opmerkingen