Xi, Biden, Boeing / SPX500 4400+ / EURJPY 162+ pushing towards 2008 highs / U.S CPI next up tom

- Stéphan

- Nov 13, 2023

- 2 min read

China considers resuming purchases of Boeing's 737 Max aircraft when Xi, Biden meet this week, nothing like a friendly gesture ahead of a big high profile meeting

The playbook for 2024 will be slower growth and market pricing in easier policy (GS and MS diff take, as in market), great week for the magnificent 7 last week, a great year in fact, and no need to remind everyone that they are making up 90% of the S&P move YTD, bar any real new news, set-up would appear to be bullish into year-end >>> debt ceiling issue, possibly debt downgrade and next up U.S CPI on Wednesday key for short-term sentiment (no auction this week)

Moody's turns negative on US credit rating, draws Washington ire

Moody’s tail Risk has Italy on edge before critical rating call. Country is rated one step above junk, with negative outlook. Assessment by Moody’s would be first since Meloni’s budget

GOLDMAN: “The hard part of the inflation fight now looks over .. the heaviest blows from monetary and fiscal tightening are well behind us .. We expect the FOMC to .. cut in Q4 2024 once core PCE inflation falls below 2.5%. We then expect one 25bp cut per quarter until 2026Q2 ..”

Uni Michigan survey of 12months inflation expectation rose from 4.2% to 4.4% (expected was lower to 4%)

China’s ICBC, the world’s biggest bank, hit by cyberattack that reportedly disrupted Treasury markets

The average price of a used Tesla has declined 16 months in a row, moving from a record high of $67,900 in July 2022 to a record low of $39,550 today (-42%)

House Republicans look to pass two-step package to avoid partial government shutdown

Iceland braces for volcanic eruption: As state of emergency is declared

Markets :

In FXland, CROSSJPY's pushing higher still/breaking up again, markets got tired and is challenging the BoJ 'talk talk',

Gold : 200dma around $1935 - the hold area for the bulls

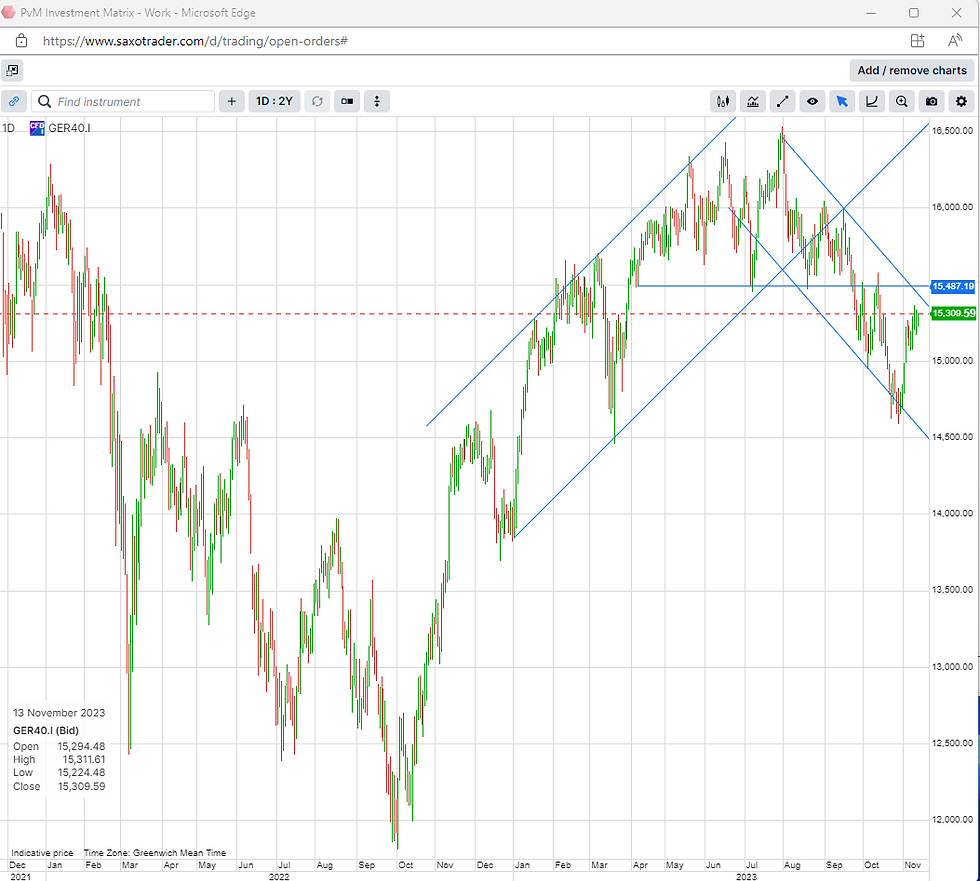

SPX500 above 4420+ and further shorts will most likely be cut, year-end rally calls will be on the increase again - chart. DAX still in downtrend, but 11500+ and more squeeze coming

Bonds pretty steady after Moody's - no real surprise nor impact, U.S CPI key this week though

MS sees FFR to 2.4% by 2025 and GS 4.% - Fed is at 3.9%

Surprise!

London politics LIVE: Cabinet reshuffle under way as ministers tell Rishi Sunak to sack Suella Braverman (msn.com) yet another reshuffle..

SPX500

DAX - still in downtrend, 11500+ and that would squeeze few more 'bears'

Comments